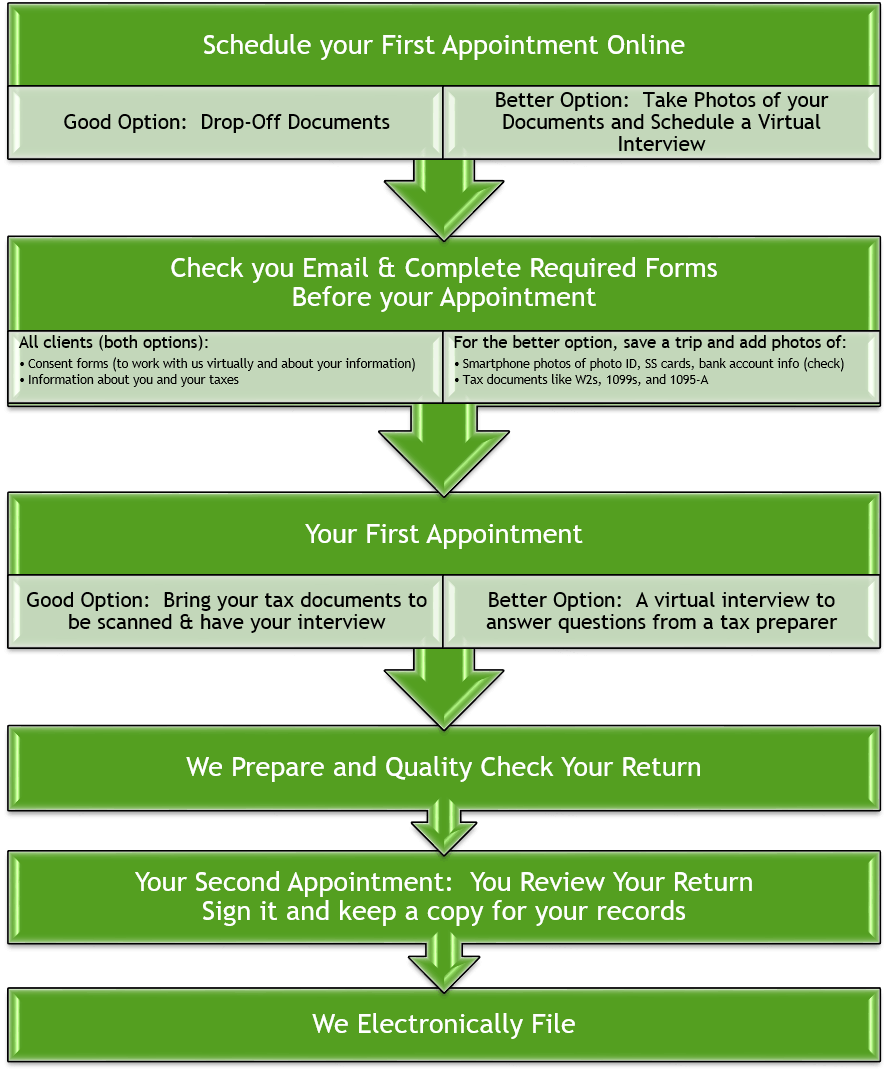

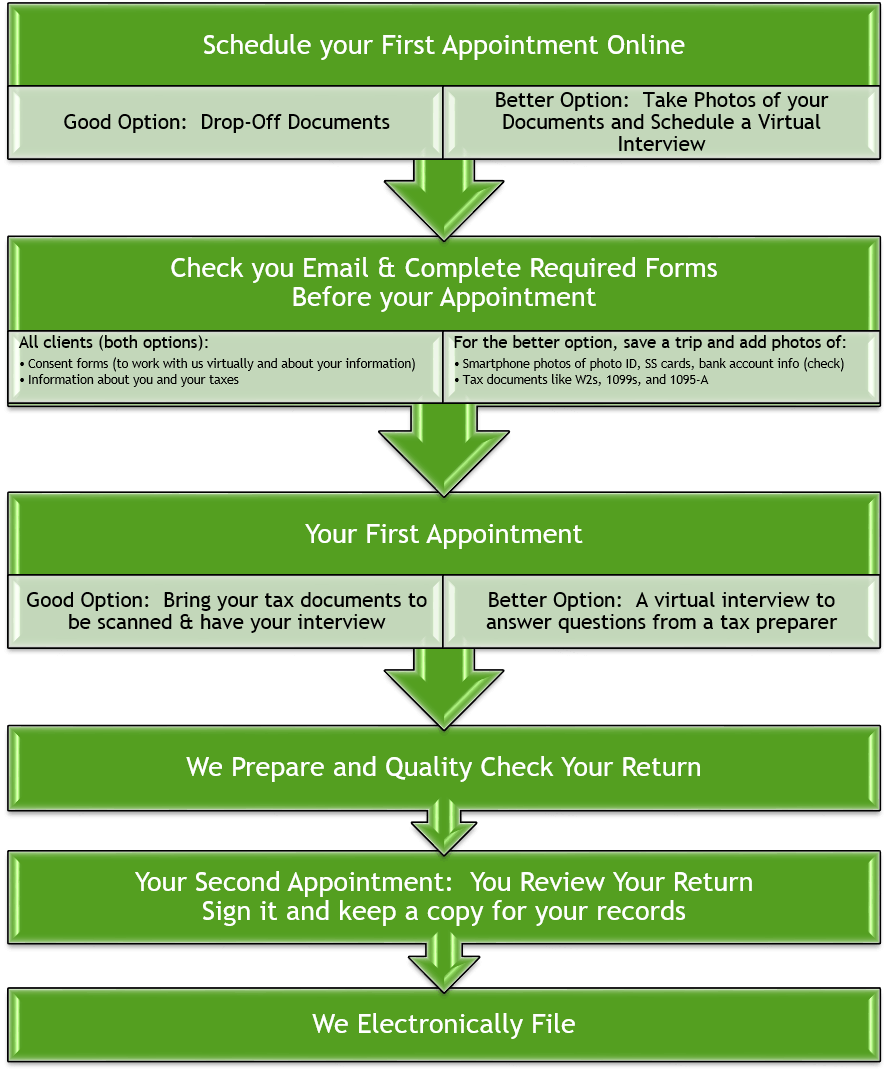

Overview of the Process

For 2021, taxes at the Herndon Neighborhood Resource Center (HNRC) will be virtual, so this site will help you understand the new process and get you started.

If your income was under $57,000 in 2020, you can use our program for no-cost tax filing. Learn more from the IRS about who qualifies for our free service.

Overview of the Process

Overview of scheduling and form completion

Start by scheduling an appointment for your virtual interview. Prior to the appointment, you'll need to complete some consent forms required by the IRS and also the form that provides information about you, people who live with you, and your tax situation. Those forms will be sent to you from DocuSign once your appointment is scheduled.

Click the video to learn more.

Overview of documents we need and uploading

We prefer that you add the necessary documents directly either from your computer or take photos on your phone and upload them directly with your identification, Social Security cards or ITINs, and all tax forms.

If you can't upload the documents yourself on your smartphone or a computer, schedule an appointment at the Herndon Neighborhood Resource Center (1086 Elden Street, Herndon, VA 20170) to have your documents scanned and uploaded.

IMPORTANT: You need to do your drop-off between completing your forms and your interview.

Schedule drop-off here.

Overview of your virtual interview

Your virtual interview will allow a certified tax preparer to fully understand your tax situation for last year so we can prepare an accurate tax return. The volunteer will review all of your documents and ask questions. You should also ask questions of the volunteer.

Over the next week, sit back as we prepare and quality review your return. Be sure the schedule the appointment for your review with a tax preparer of your completed return here.

Overview of finishing your tax return so we can eFile

Prior to your tax return review appointment, check your email for another message from DocuSign that will contain a link to your completed tax return. Have that available for your appointment with the tax preparer.

When your review is complete, you'll sign the return and click finish so that we can electronically file (eFile) your taxes. If you're getting refunds, they should arrive in a few weeks separately from the IRS and state.

Click the link below to schedule your virtual interview and then complete the forms in your email.

Book Interview Appointment